E-Invoicing in Saudi Arabia

On December 4th, 2020, Zakat, Tax, and Customs Authority (ZATCA) / Previously known as the General Authority of Zakat and Tax (GAZT), announced that its Directors Board had approved E-Invoicing regulations which became effective the day it was published. But what is the E-Invoicing project?

The E-Invoicing project is a procedure that aims to replace the issuance of paper/traditional invoices:

- Handwritten invoices that are kept in physical files

- Scanned invoices that are uploaded to the desktop or any electronic device

- Invoices written in spreadsheets and word editing programs

with a structured electronic process.

Invoicing will be more electronic-centric. It will revolve around using an electronic system to issue, store, exchange invoices in a structured electronic format between buyer and seller.

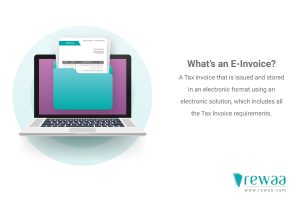

What is an E-Invoice?

An invoice issued, stored, amended/modified, and exchanged in an electronic format using an electronic solution (for example, a handwritten invoice that is scanned is not considered an electronic invoice).

These invoices issued within the E-Invoicing project are all Tax Invoices (whether they represent a Tax or a Tax Simplified invoice) that are usually issued as a commercial document to confirm the goods and services provided to the customer and prove the amounts be paid for those goods and services. Therefore, E-Invoices should include and meet all the Tax Invoice requirements (which we will cover later in this blog).

What are the steps of implementing E-Invoicing?

The implementation of E-Invoicing is divided into two main phases:

The first phase, starting from December 4th, 2021: Should start issuing/generating, and storing e-invoices that include all the requirements of tax invoices using a system (such as a Cashier/POS system). The process involves any taxable individuals/institutions for VAT purposes and anyone who issues tax invoices on behalf of them.

The second phase, starting from January 1st, 2023: Will integrate the system used to issue the E-Invoices (such as Rewaa Cashier System) with ZATCA’s systems to enable sharing and sending data and info through it.

Who is subject to the Electronic Invoicing Regulation?

All taxable individuals/institutions for VAT purposes (excluding non-residents in Saudi Arabia), and any third party issuing tax invoices on behalf of taxable individuals, must start issuing E-Invoices by December 4th, 2021.

And simply put, to determine whether you are taxable for VAT purposes or required to register as a taxable individual or not:

If you carry on an Economic Activity and your:

- Taxable supplies over 12 months exceed SAR 375,000 (the Mandatory VAT Registration Threshold). You must register for VAT.

- Taxable supplies over 12 months of SAR 187,500 (the Optional VAT Registration Threshold). You may register for VAT voluntarily.

- Taxable supplies are less than SAR 187,500. You are ineligible to register for VAT.

In conclusion, you must issue E-invoices if:

- You live in Saudi Arabia and are taxable for VAT purposes.

- If you issue tax invoices on behalf of a person who is taxable for VAT purposes.

When do retailers issue E-Invoices?

If you are a retailer who is taxable for VAT purposes, and you serve the end consumer, you will issue E-Invoices for:

Every time you issue a tax invoice when selling to the end consumer. Meaning you will continue to issue tax invoices as you used to. However, instead of issuing them in paper format, you will start issuing them using an electronic solution/system compatible with ZATCA’s requirements.

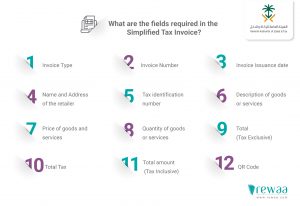

What are the fields required in the E-Invoice?

As mentioned above, E-Invoices include Tax Invoices and Simplified Tax Invoices under the VAT Regulation. As for the Simplified Tax (sale invoices), no specific formula must be followed when issuing them. However, E-Invoices that will be issued on December 4th, 2021, must include specific fields considered a requirement for Simplified Tax Invoices:

- Type of invoice (Simplified Invoice)

- If the invoice is issued on behalf of a taxable person, it must be stated that “a third party issued the invoice on behalf of….”

- Invoice Number

- QR Code

- The date the invoice was issued

- Name and Address of the taxable person

- Tax identification number of the taxable person

- Description of goods or services to be sold

- Price of goods and services to be sold

- Quantity of goods or services sold

- Total (Tax Exclusive)

- Total Tax

- Total amount (Tax Inclusive)

What are the requirements of the solution used to issue E-Invoices?

Handwritten invoices or invoices that are scanned are not considered an E-Invoice, nor does an invoice written using a text editor and any word processing program. Issuing E-Invoices requires using an electronic E-Invoicing system that issues, saves, and sends the invoice itself in an electronic format.

What is meant by Electronic Means or Electronic Systems is any device or electronic solution that is used to issue E-Invoices such as POS (Cashiers), ERP Systems, Accounting Software. Any system picked must meet the following minimum requirements to be considered a compliant E-Invoicing system:

1- Must connect to the Internet (like cloud-based software)

2- Must allow integrating with external systems through Application Programming Interface (API).

3- Must be a tamperproof solution (anti-tampering) that detects tampering or editing performed on the invoices.

4- Must comply with the requirements of Cybersecurity in the Kingdom of Saudi Arabia.

5- Can control and manage users’ permissions within the system.

Are there any requirements in issuing and sharing E-Invoices?

1- It should be issued in Arabic, and it may be issued in other languages besides Arabic.

2- It must include all the information and fields of the Tax Invoices mentioned above.

3- The invoice to be issued in XML format or 3-PDF/A.

4- Present the customers with a printed copy of the E-Invoice.

After issuing the E-Invoices, what are the requirements for storing them?

The E-Invoices regulations and program are connected heavily with Value Added Tax (VAT) regulations. Therefore, ZATCA announced that the policy of keeping E-Invoices matches the requirements for keeping invoices mentioned in the VAT regulation:

1- A taxable person must keep their invoices and records and their accounting documents for at least 6 years from the end of the tax period.

2- These records and invoices must be kept and issued in Arabic.

3- Records must be stored in a server that allows access to those records.

4- The server must be located in the Kingdom of Saudi Arabia, and in case it was located abroad, there must be a terminal station that allows accessing the data.

5- Ensure security measures, and guarantee tamper resistance.

6- ZATCA has the right to review the systems used by the taxable person to work on his accounts.

To conclude, how can you guarantee abiding by the E-Invoices regulations on December 4, 2021?

- Issue all your Tax invoices in electronic format starting from December 4, 2021.

- Use a system that complies with the provisions in the Electronic Billing Regulations that are related to the E-Invoicing system requirements.

- Make sure that the issued E-invoices consist of all the Tax Invoice requirements.

- Comply with the Records and E-Invoices storing requirements referred to in the VAT regulation.

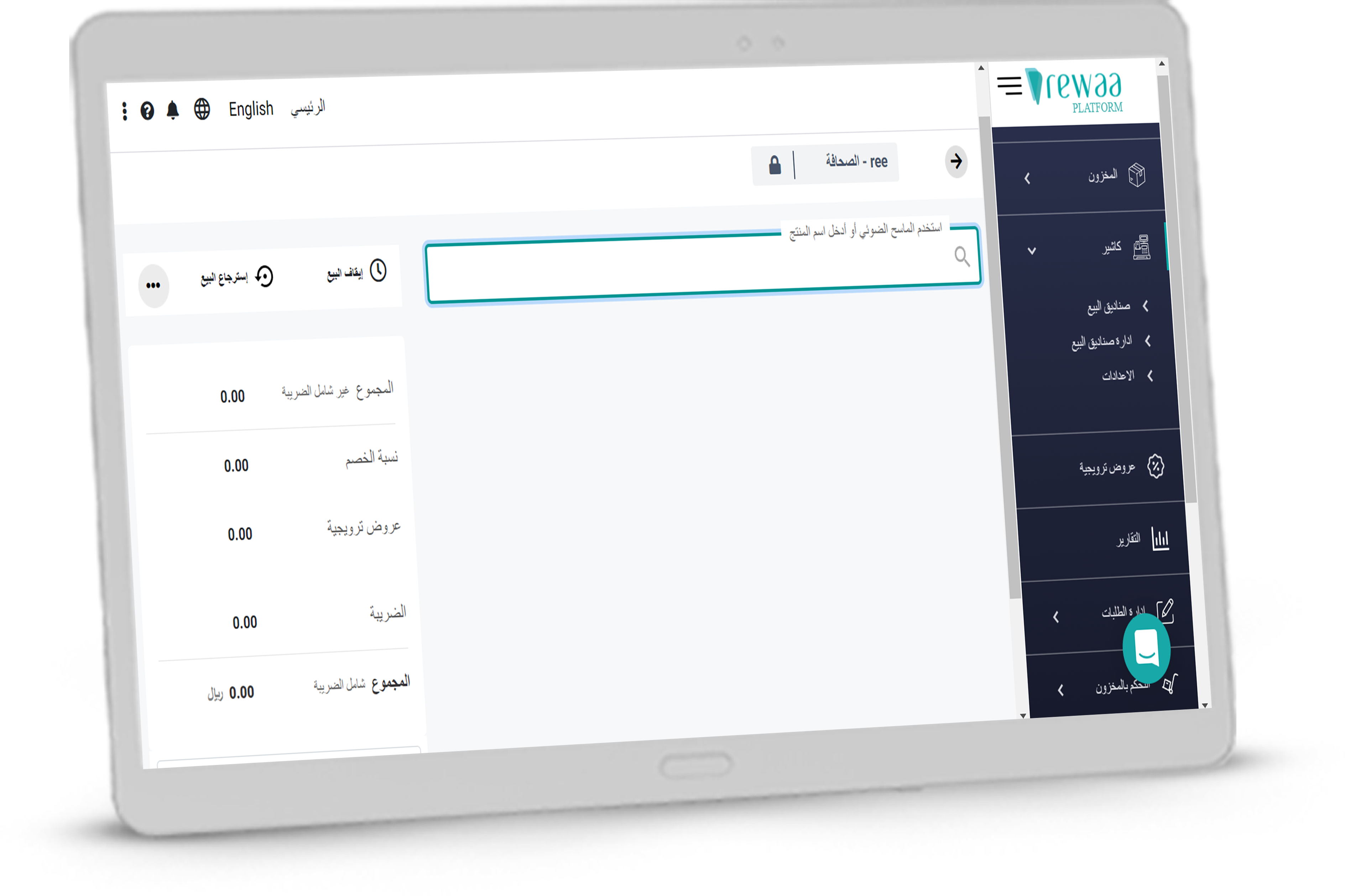

Need an electronic solution for your E-Invoices?

Rewaa POS complies with the ZATCA’s requirements:

- Rawaa offers a cloud-based Cashier System, which allows the issuing and storing of an unlimited number of E-invoices.

- The E-invoices include all the fields required in the tax invoice issued for the end consumer.

- Rewaa Cashier works with all types of invoice printers.

- Allows the integration with external systems using the Application Programming Interface (API)

A one-stop-shop for retailers! Additional Advantages of using Rewaa POS:

- Free technical support.

- Training employees to use the system.

- Connects all your branches to one inventory, and receives and manages your online orders through your branches’ Cashier.

- Allows an unlimited number of Cashiers for each branch.

- Integrates with Accounting System to ensure the issuance of all invoices for all sales operations and eliminate manual invoicing.